Are you paying more than necessary for your medical expenses? Here are two tips for reducing your out-of-pocket medical costs so you have more money in your wallet!

Sun Life’s Reasonable and Customary Charges

Do you know if you are being charged more than a reasonable amount for medical services like optometrists, podiatrists, and physiotherapists?

Our extended health benefits provider, Sun Life, does know if a provider is charging more than their peers, and they share these insights on their mobile app and through the online Sun Life account (www.mysunlife.ca). This means you can make an informed decision about the services you are being reimbursed for by checking a provider before you book and making sure they are charging a reasonable and customary amount for their services.

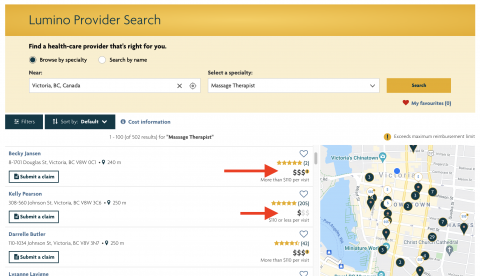

Using data from across the province, and across Canada, Sun life will determine “reasonable and customary” charges when reimbursing your paramedical, eye exam and other services. This is also subject to the reimbursement level and maximum amounts specified under UBC’s Extended Health Plan. For example, when searching for a paramedical practitioner, like a massage therapist in the Lumino Provider search located on the home page of your Sun Life account, you will see the reasonable and customary charge limitations indicated by a dollar ($) sign – it is a similar system the food delivery services use to show whether you are getting fast food or a fancy five-star meal: the more dollar signs the higher the price.

One- or two-dollar signs indicate the practitioner is charging within the reasonable and customary charge limit. Three or more dollar signs indicates they are charging over the reasonable and customary rate and you will be responsible for the extra cost.

Next time you access a medical service or supplier and seek reimbursement through Sun Life, take a look at that provider’s reasonable and customary cost compared to other providers – you could save a bundle, and ensure your annual coverage amounts are used effectively.

Sun Life’s Delisted Providers

We generally trust medical service providers. If they are selling their services on day-time TV we might be a little more skeptical, but for the most part, if we see a practitioner offering their services nearby, we will take them on to help with our medical issues. Unfortunately, not all providers are worthy of your trust or your money. Thankfully, Sun Life can help us determine if we are about to book our next appointment with a trusted professional.

Sun Life sometimes finds it necessary to disallow certain healthcare service providers, clinics, facilities, or medical suppliers from claims processing and reimbursement. Sun Life does this to better protect your plan. When Sun Life delists a provider, they will no longer process or pay for claims for services or supplies obtained from that provider. These providers are placed on Sun Life’s “delisted providers” list.

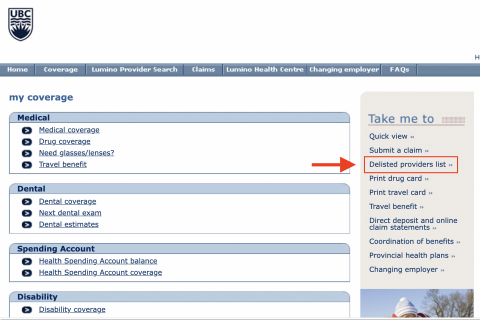

The delisted providers list is regularly updated. To view the most recent delisted providers, log in to your Sun Life account via www.mysunlife.ca and select “Coverage Information”. You can find the message for delisted providers on the right-hand side of the screen.

When the list pops up in a new window, you will need to scroll down to the appropriate province and search through the alphabetical list to see if the provider has been delisted.

(Can’t see the list? You may need to turn off your pop-up blockers).

We encourage you to check the list (tis the season, maybe check it twice?) so that you don’t unknowingly use a delisted provider. Remember, if the provider has been delisted your claim will be declined by Sun Life.

More information on Extended Health benefits coverage can be found here.

Posted in Articles

Tagged

- HR

- Benefits FYI

- HR Network News